Zakat in Islam

Zakat is one of the fundamental pillars in Islam, as it is considered a legitimate imposition on money and property that goes beyond the squint. Zakat aims to achieve social justice by distributing wealth among the poor and needy in society. Zakat is an opportunity for Muslims to show their compassion, community Brotherhood and social solidarity. Zakat is also considered a way to purify oneself and get closer to God by giving part of the wealth earned honestly and sincerely.

The concept of Zakat in Islam

Zakat in Islam means to give a certain part of the wealth honestly and sincerely. Zakat is an opportunity for Muslims to express their sympathy and brotherhood in society. Muslims pay zakat to the poor and needy to achieve social justice and solidarity. Zakat completes fasting and prayer and is considered a legitimate imposition in Islam. By paying Zakat, Muslims contribute to raising poverty, need and achieving social justice in society.

The importance of Zakat in Islam and its provisions

Zakat occupies an important place in Islam, as it is one of the five pillars of Islam. The payment of Zakat expresses giving, solidarity and social solidarity, contributes to the achievement of social justice and the equal distribution of wealth. Zakat hopes to alleviate need and poverty and promote peaceful coexistence in society. Zakat encourages Muslims to give and give and promotes the values of justice, transparency and sincerity in charity.

Legitimate assets of the Zakat account

The calculation of Zakat is considered one of the basic things in Islam and is based on specific legitimate origins. This includes the determination of the quorum and the time transfer of funds covered by Zakat. The quorum is calculated at 2.5% of the total value of funds and assets owned by an individual for about a full period in the lunar Hijri year. The calculation of Zakat requires accuracy and care to ensure that it is paid correctly in accordance with Sharia laws.

How to determine the Nisab and squint to calculate Zakat

Calculating Zakat requires a person to accurately determine the Nisab and squint. The quorum is determined by the sum of funds and assets that a person owns, and 2.5% of their value is calculated as the amount of Zakat due. As for strabismus, it is the passage of a whole period of time after the quorum is completed. Strabismus should be measured and determined strictly in accordance with the Sharia Laws of Zakat. A person must be accurate in determining the Nisab and Strabismus and make sure that zakat is paid in a timely manner.

Zakat in Islam

Types of funds that are subject to zakat

The types of funds that are subject to zakat include many varieties, some of which pay zakat on it annually and some of which pay zakat on it when the strabismus is depleted. Among the funds that are subject to zakat are: cash money, gold and silver, agricultural crops, livestock and animals, real estate and contracts, business profits and investments, stocks and securities, debts due for legitimate rights. A person must determine the value of each type of money that he owns and calculate Zakat on it in accordance with the appropriate Sharia provisions.

Ruling on Zakat on cash, money and other funds

Zakat is considered a legitimate duty on money and accumulated funds at the end of the legitimate transfer. Zakat must be paid on the cash and money that a person owns if he exceeds the specified quorum (the financial value that meets the legitimate conditions of Zakat). Real estate, contracts, urban profits, real estate investments and outstanding debts are also subject to zakat for legitimate rights. Zakat must be calculated by knowing the value of these funds and paying a percentage of them in accordance with the Sharia provisions.

How to calculate Zakat on cash funds

Zakat on cash is calculated according to the percentage of 2.5% of its total value. The value of the cash in the wallet, bank accounts, investment accounts, safes and unused money in the person’s trade must be calculated. Zakat must be paid on these funds that are available for a whole year on about the day on which the person was forced to pay it. Zakat should be calculated after excluding outstanding debts and other obligations.

The percentage of calculating Zakat on cash funds

Zakat on cash is calculated at a specific percentage, which is 2.5% of its total value. At this percentage, a small part of the cash should be paid as an annual zakat to the poor and needy. The ratio is calculated based on the total value of cash in wallets, bank accounts, investment accounts, safes and unused money in trade. This calculation is aimed at activating the economy and distributing wealth in a fair way in society.

Special provisions for calculating Zakat

The calculation of Zakat includes some special provisions that must be observed. For example, Zakat should be calculated on the differences in investment funds and profits earned from contracts and business. The value of sales, profits, debts accrued and payable should also be estimated when calculating Zakat on commercial funds. Compliance with these special provisions is an essential part of understanding and implementing the imposition of Zakat in Islam.

Zakat in Islam

Zakat on trade, gold, silver and crops

Trade, gold, silver and crops are subject to special provisions in the calculation of Zakat. Trade zakat is calculated at 2.5% of the value of the commercial inventory after its disposal for a full year. For gold and silver, zakat is calculated on the monetary value of them and half a tenth is charged for each. As for agricultural crops, zakat is calculated at 10% if they are irrigated with natural water, and 20% if they are irrigated with artificial water.

Conclusion

In conclusion, it can be said that zakat is one of the five pillars of Islam, a legitimate imposition that urges Muslims to distribute part of their wealth to the needy and the poor. Calculating Zakat requires a correct understanding of its provisions and their application at the time of al-Hawl. With the obligation of Muslims to pay zakat, a balance is achieved in society and justice and mercy prevail through social solidarity and helping those in need. Muslims must adhere to the exact calculation of Zakat to achieve wages and reward in this world and the hereafter.

The importance of paying Zakat in Islam and its positive impact

Paying zakat is one of the basic Islamic duties, as it plays an important role in achieving social and economic balance in the Muslim community. Thanks to zakat, wealth is distributed equitably among all members of society, helping the poor and needy, relieving the burden from their shoulders. The payment of Zakat achieves mercy and justice in society and spreads goodness and blessing in funds and individuals. The payment of Zakat is an expression of social solidarity and the strengthening of social ties between members of society.

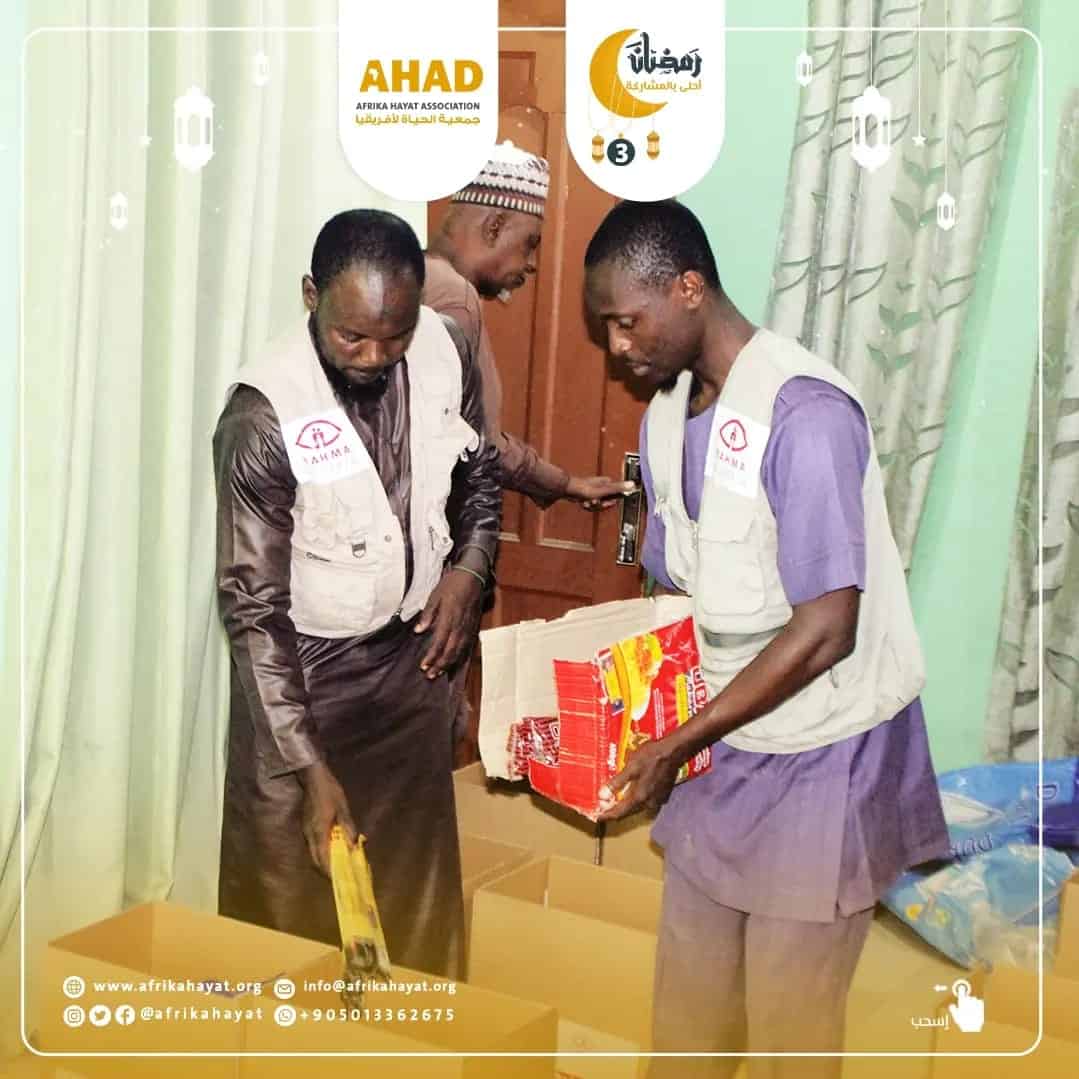

You can visit the Ahad Association website to find out more about the projects it offers

Related articles:

Social and economic benefits of Zakat

Join us in our message by donating