In reality, Zakat is the obligatory charity that Muslims are required to give annually, and it is meant to support the needy and the poor. Charitable organizations play an important role in collecting these funds and directing them towards projects and activities that promote goodness and serve the community. However, there are conditions and controls for disbursing Zakat to charitable organizations. The organizations must ensure that the funds will be used for legitimate purposes and deserving recipients. In general, we will explore this topic in our article and through the AHAD , and we will answer the question of whether it is permissible to spend Zakat on charitable organizations and other related inquiries. Just follow along with us.

Is it permissible to spend Zakat on charitable organizations?

Is it permissible to spend Zakat on charitable organizations?

In fact, giving and disbursing Zakat to charitable organizations or organizations that assist the needy is considered a form of delegation to these organizations to deliver Zakat to its rightful recipients. This is permissible, but with the condition that:

- The individuals running these organizations are trustworthy.

- They spend the money in legitimate channels.

Charity, in general, encompasses all righteous deeds performed by humans. This is indicated by the saying of the Prophet Muhammad, peace be upon him: “Every act of goodness is charity.” Charitable organizations are usually qualified to deal with these matters and direct the funds appropriately.

On the other hand, AHAD is considered a charitable organization that works to provide support and services to the needy and the poor. These services may include assistance in areas such as education and healthcare.

Is it permissible to use Zakat funds for a charitable project?

Yes, it is permissible to spend Zakat funds on legitimate charitable projects according to Islamic Sharia. On the other hand, Zakat is a religious obligation for Muslims and is one of the pillars of Islam. Zakat funds can be used to assist the poor and needy and improve their economic situation. However, it is important that Zakat funds are carefully disbursed and in accordance with the guidelines of Sharia. Additionally, the following should be considered:

- The charitable project must be eligible to receive Zakat.

- The funds should be monitored and managed carefully to ensure they reach deserving recipients who are genuinely in need.

Furthermore, the Fatwa Department of the Egyptian Dar Al-Ifta answered a question regarding irrigation channels and their permissibility for expenditure in a project, stating: “Providing water to villages, especially those deprived, can be considered as an expenditure of Zakat and spent in the cause of Allah.”

Is it permissible to spend Zakat on charitable organizations?

On the other hand, AHAD has contributed to a total of 1,211 charitable projects, including:

- 472 food projects in 6 countries in Africa, benefiting over 80,070 individuals.

- 200 sacrificial projects.

- 6 development projects.

- 11 healthcare projects.

- 31 relief projects in Africa, benefiting more than 2,500 individuals.

These types of assistance can be categorized as follows:

| Project Type | Financial Aid | Zakat | Children’s Clothing | Gifts Number |

| Number of Beneficiaries | 1159 | 70 | 722 | 550 |

Is it permissible to spend Zakat on providing water?

Indeed, it is permissible to spend Zakat on providing water and establishing water sources for those in need in Islam. Providing water and ensuring access to it is considered a legitimate use of Zakat funds. The necessity of such projects arises due to the following reasons:

Water is an essential necessity for life, and therefore, supporting water projects through Zakat funds is encouraged, especially in areas suffering from water scarcity and urgent need.

These projects significantly improve people’s quality of life and promote social justice, aligning with the objectives of Zakat to assist the poor and needy.

Is it permissible to spend Zakat on charitable organizations?

It is important to ensure that water projects meet the necessary conditions and Sharia guidelines for proper and effective expenditure of Zakat to achieve the intended purpose.

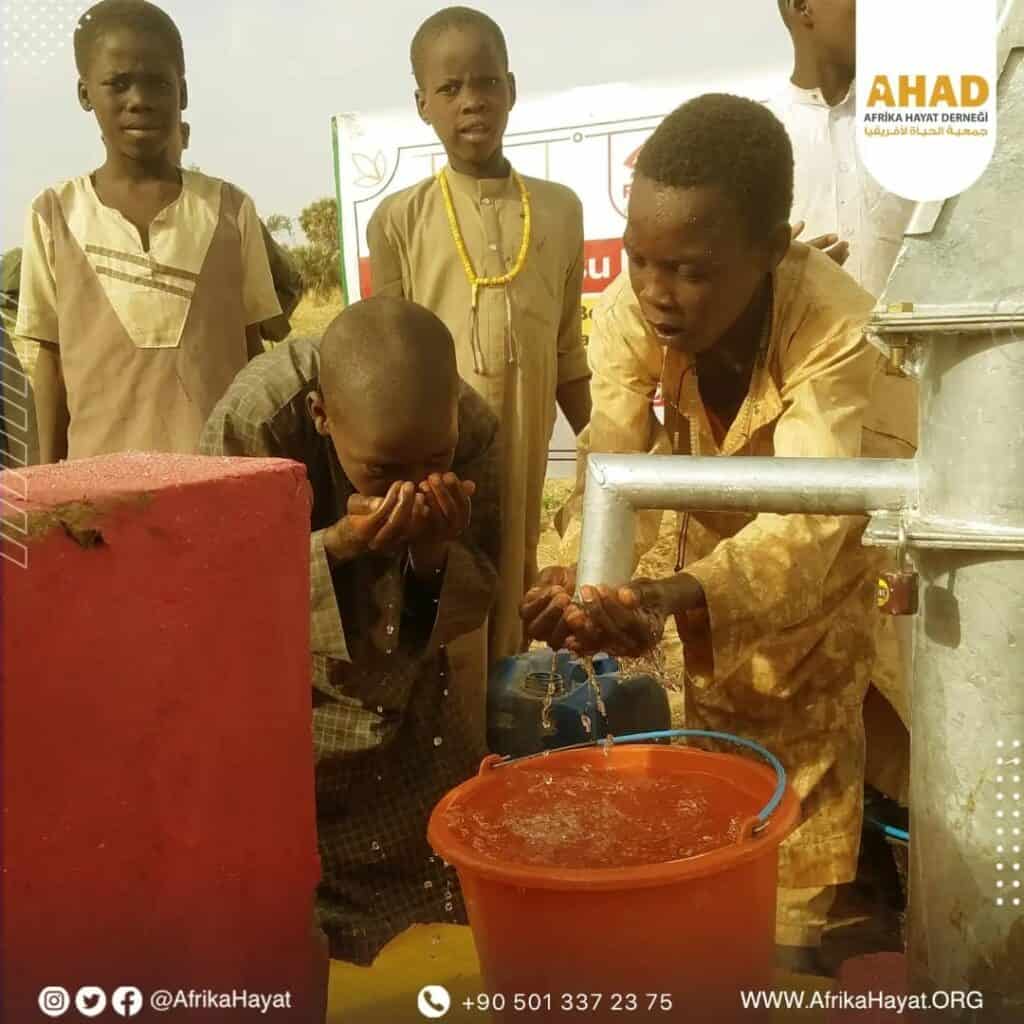

Furthermore, AHAD has implemented 453 water projects in 10 countries worldwide, benefiting over 96,650 individuals.

Delegating Charitable Organizations for Zakat Al-Fitr

Indeed, it is permissible to delegate the payment of Zakat Al-Fitr to eligible recipients. The Prophet Muhammad, peace be upon him, sent his workers to collect and distribute the Sadaqat (charitable contributions). When he sent Mu’az to Yemen, he instructed him: “Inform them that they have an obligation to give Sadaqah from their wealthy to their poor.” If they obey you in that, then beware of accepting their best properties as Sadaqah.”

It is customary to delegate the payment of Zakat Al-Fitr through presenting it to recognized charitable organizations or humanitarian institutions. These organizations will then distribute it correctly to the eligible recipients. This facilitates the process of collecting and distributing Zakat Al-Fitr, ensuring its timely delivery to those in need.

also Read

The ruling on giving Zakat for digging wells and Quran memorization

In Zakat, it is necessary to allocate it to its eligible recipients among the categories mentioned by Allah in the Quran. Allah Almighty says, “Zakat expenditures are only for the poor and for the needy and for those employed to collect Zakat and for bringing hearts together for Islam and for freeing captives or slaves and for those in debt and for the cause of Allah and for the stranded traveler – an obligation imposed by Allah. And Allah is Knowing and Wise.” (Sura At-Tawbah, 60). Therefore, digging wells, building mosques, schools, and hospitals are all acts of charity and ongoing charity (Sadaqah Jariyah). However, they are considered from the funds of voluntary charity (Sadaqah) and not a valid expenditure of Zakat.

On the other hand, giving Zakat for digging wells and Quran memorization is a blessed and commendable charitable act in Islam. Digging wells and providing water sources serve people and meet their basic needs, which aligns with the objectives of Zakat in assisting the needy and improving their conditions.

Is it permissible to spend Zakat on charitable organizations?

Quran memorization is also a great effort and highly encouraged. The Quran is the sacred book of Islam, and learning and teaching it are considered praiseworthy actions and hold great religious value. It is worth mentioning that AHAD has distributed the Noble Quran in 14 countries worldwide.

In conclusion, by answering the question of whether it is permissible to spend Zakat on charitable organizations, you can contribute by donating to AHAD and earn rewards.

Frequently Asked Questions

What are the guidelines for Zakat for non-profit organizations and charitable associations?

Zakat is not obligatory for non-profit organizations and charitable associations if the following conditions are met:

- The funds should not belong to a specific individual but should benefit the organization as a whole.

- The financial returns should be dedicated to general charitable purposes.

- The organization should have the necessary licenses and clearly defined objectives.

Is Zakat obligatory for Quran memorization centers?

It is permissible to allocate Zakat to teachers and students in Quran memorization schools if they are in need.

Is contributing to digging a well considered ongoing charity (Sadaqah Jariyah)?

Yes, individuals who are charitable can contribute to ongoing charity projects such as digging wells. This allows impoverished communities to have access to groundwater and meet their daily needs for clean water.